Article of the Week: Context for Gold, Silver and Bitcoin Price action

|

Hello Reader, Last week’s sharp selloff in Bitcoin, gold, and silver caught many investors off guard, but moves like this are not unusual, especially in Bitcoin’s history. What is unusual is how little most retail investors understand about what actually causes them. In this week’s article, James Lavish explains the mechanics behind the drawdown, ETF flows, derivatives, leverage, and institutional “basis trades”, and why short-term price declines often have far more to do with market structure than with fundamentals. Some of what he shares may be beyond your current investment knowledge, but you don't need to understand all the details to benefit from the big picture. So without further ado, here is what James Lavish wrote: 💡 Is “Paper Bitcoin” Killing the Price? Issue 204James Lavish, CFAFeb 08, 2026∙ Paid ✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week. 🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text. 🫶 If this email was forwarded to you, then you have awesome friends, click below to join! 👉 And you can always check out the archives to read more of The Informationist. Today’s Bullets:

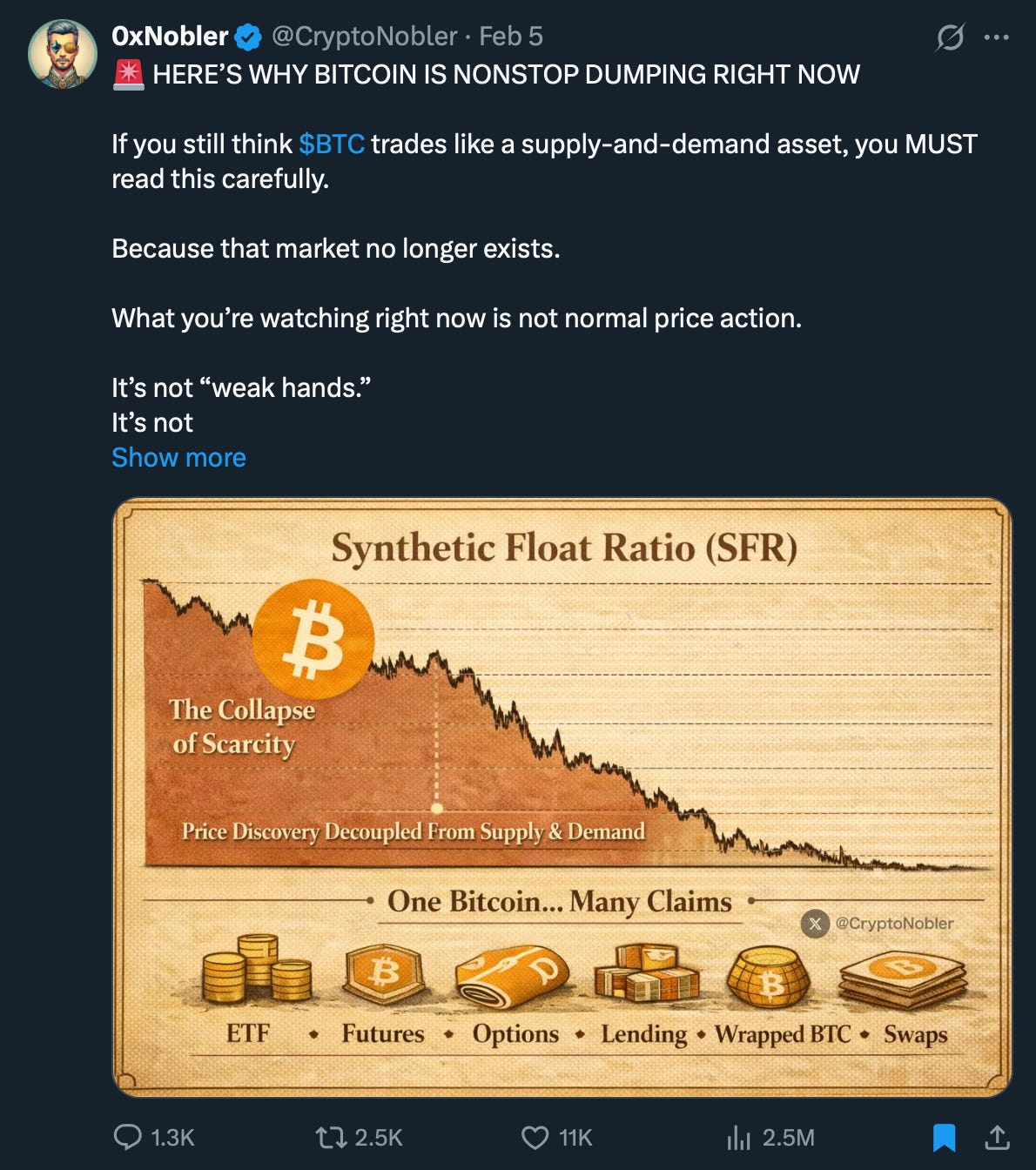

Inspirational Tweet:

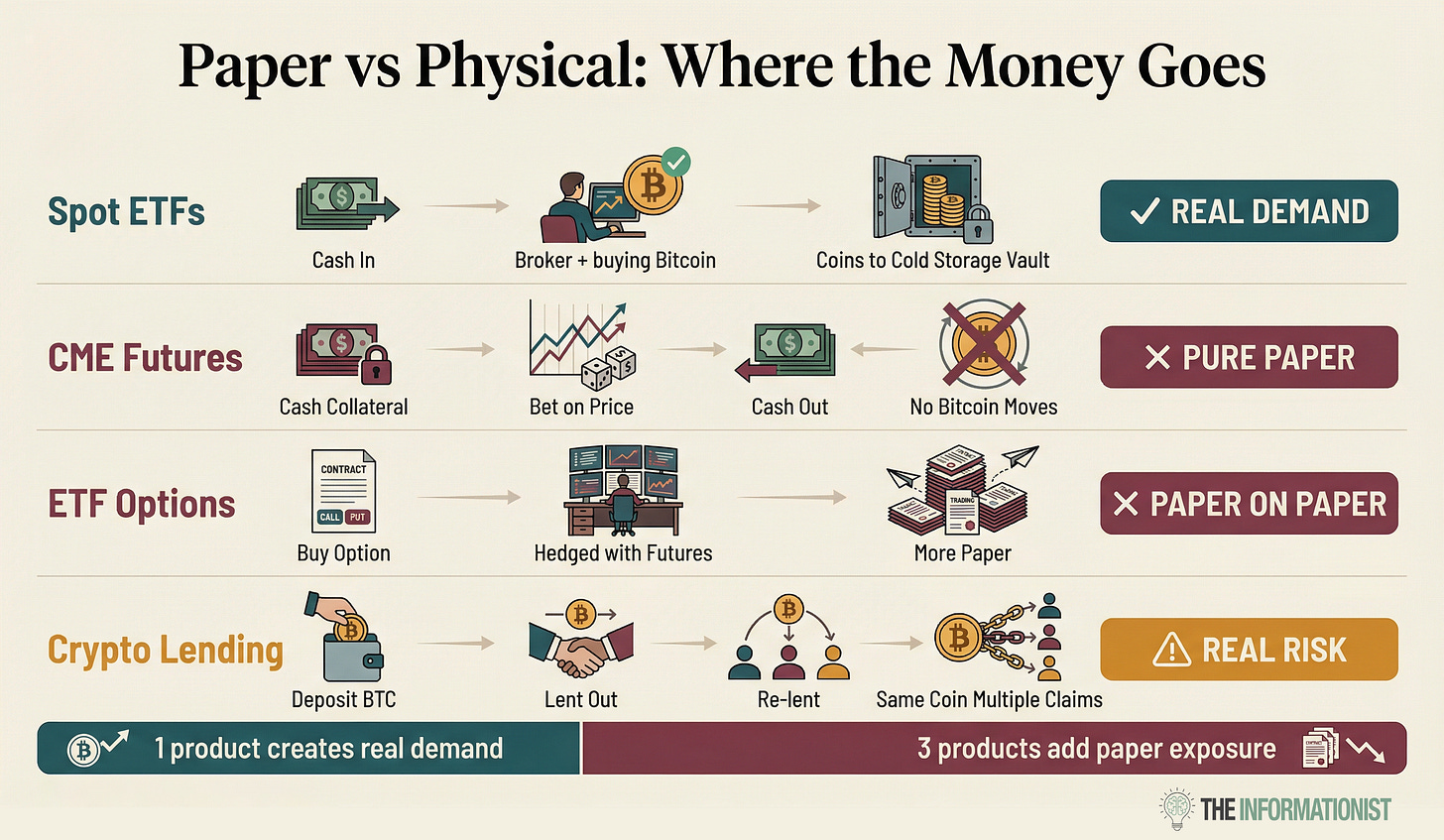

If your timeline looks anything like mine this week, you’ve seen some version of this argument everywhere. “Paper Bitcoin is destroying price discovery.” or maybe, “One Bitcoin, many claims.” And my favorite… “Wall Street broke Bitcoin.” And I honestly think this is a conversation worth having. After all, Bitcoin has been steadily dropping for months, from $125K to $60K. It’s been rough to say the least. When moves like that happen, people want answers. And the “paper Bitcoin” narrative offers a clean one: Wall Street created too much synthetic exposure, and it’s suppressing the real price. Parts of that are true. The question is, which of these products create exposure without touching actual coins, and can derivatives actually affect short-term price discovery? Negatively and/or positively? Great questions that deserve serious consideration and answers, ones that we will sift through, nice and easy as always, here today. So, pour yourself a big cup of coffee and settle into your favorite seat for a look into the world of paper Bitcoin with this Sunday’s Informationist. 📰 The Paper Bitcoin QuestionLet me show you two numbers. As of mid-January, spot Bitcoin ETFs held approximately $120 billion worth of actual Bitcoin in cold storage. Remember, because they are spot ETFs, these funds are required to hold real Bitcoin equal to the value of their shares. When money flows in, they must go and buy actual coins on the open market. Real coins. Really purchased. Locked away. And that’s just the ETFs. Billions of dollars worth of Bitcoin trade on exchanges like Coinbase and Binance every day, held by individuals and institutions alike. But since the ETFs report their holdings publicly, they give us the clearest window into institutional physical demand. As for non-physical Bitcoin, in January derivatives markets carried roughly $125 billion in open interest across futures and options. These are much of the paper claims everyone is talking about. Paper claims on an asset that has a hard cap of 21 million coins. Paper claims exceeding all the ETF physical holdings. And it gets wilder from there. See, in the same month, Bitcoin derivatives were trading at roughly $196 billion in volume vs. spot BTC trading about $26 billion. That’s a 7.5-to-1 ratio. In other words, for every dollar of real Bitcoin changing hands, seven and a half dollars of paper Bitcoin were trading alongside it. So when people ask whether “paper Bitcoin” is affecting price discovery, the answer is obviously yes. At that scale, how could it not? But here’s the thing. Not all of that paper works the same way. Some products, like the spot ETFs, require actual Bitcoin to be purchased and held. Others, like CME futures, never touch a single satoshi. And one of them, a massive trade most people have never heard of, explains a huge chunk of the ETF outflows (money leaving the Bitcoin ETFs) that made headlines all through January. Understanding which is which changes how you read every headline about this selloff. The “record shorts.” The ETF outflows. The liquidation cascades. All of it looks different once you see the mechanics underneath. How? Let’s walk through each of them, one by one. ⚖️ Paper vs PhysicalFirst, take a look at this infographic to see where the money is and where it is going, depending on whether it is physical or paper.

Spot ETFs: Real Coins, Really PurchasedWe covered the basics in the last section. Spot ETFs have to hold the real thing. Money comes in, Bitcoin gets bought. If you are wondering how that actually works, or want a refresher, I wrote a full breakdown a while ago. You can find exactly that here:

James Lavish, CFA·January 7, 2024Read full story For the TL;DR crowd: When you buy shares of BlackRock’s IBIT or Fidelity’s FBTC, your money doesn’t just sit in a fund somewhere. A designated broker takes that cash to Coinbase Prime (the institutional arm of Coinbase) and buys actual Bitcoin on the open market. Those coins then move into segregated cold storage wallets. Completely removed from circulating supply. Since these ETFs launched in January 2024, they’ve accumulated approximately 1.27 million Bitcoin. That’s over 6% of all Bitcoin that will ever exist, sitting in custody. Not trading. Not on exchanges. Locked up. Now, you can buy and sell IBIT shares on the Nasdaq all day long without a single Bitcoin moving. But here’s why it still connects to real demand. If IBIT’s share price drifts away from the value of the Bitcoin it holds, big trading firms (called Approved Participants) step in. They either buy cheap shares and redeem them for real Bitcoin, or they buy real Bitcoin and create new shares. This keeps the price in line. And that process requires actual Bitcoin to change hands. So the ETFs create real, physical demand for Bitcoin. The shares trading on top of them are, yes, paper. But the foundation underneath is real coins. CME Futures: Pure PaperNow let’s look at the other end of the spectrum. The CME, or Chicago Mercantile Exchange, is where most big institutional Bitcoin trading happens. And these contracts work completely differently from ETFs. No Bitcoin changes hands. Ever. Here’s how they work. Two parties make a bet on where Bitcoin’s price will be on a future date. They each put up some cash as collateral. When that date arrives, whoever was wrong pays whoever was right. In cash. In US dollars. Not a single satoshi moves. The CME currently has roughly 19,300 open Bitcoin futures contracts. That’s tens of billions in notional exposure. Tens of billions worth of bets on where the price goes. Not tens of billions of Bitcoin demand. Big difference. Now, can these paper bets affect the actual price of Bitcoin? Short term, absolutely. When a massive leveraged position gets liquidated, the futures price drops hard and fast. And because trading bots constantly watch for gaps between futures and spot prices, that drop gets transmitted to the real Bitcoin market almost instantly. The tail does wag the dog. For a while. But futures don’t change the supply. They don’t remove coins. They don’t add any. Over longer timeframes, the real market always reasserts itself. ETF Options: Paper on Top of PaperThose Bitcoin ETF options that launched to great fanfare? Quick thing worth knowing. When you buy an option on IBIT, you’d think someone on the other side is hedging by buying Bitcoin or at least buying IBIT shares. Most of the time, they’re not. They hedge with futures. So when traders pile into IBIT call options thinking they’re creating buying pressure, they’re mostly just adding to futures open interest. More paper stacked on top of paper. Not manipulation. Just how modern market making works. But it means options volume doesn’t move physical supply the way you might expect. Lending: Where the Real Risk LivesOK, now we get to the part of the paper Bitcoin story that deserves the most attention. Some platforms offer you a yield on your Bitcoin. Sounds great, right? They’ll pay you interest just for parking your coins with them. Here’s how they do it. They lend your Bitcoin out. Sometimes to traders who want to short it. Sometimes to other platforms. And sometimes those platforms lend it out again. Same coin. Multiple claims. Different people all thinking they own it at the same time. In traditional finance, this is called rehypothecation. It’s essentially how banks work. Your money is “in your account,” but it’s actually been lent out to someone else. Works great until too many people want their money back at once. If you want to see how this kind of leverage can spiral, I just wrote all about it here:

Basically, the mechanics are the same whether it’s hedge funds or crypto lending platforms. And we saw exactly what happens when it goes wrong. It’s how BlockFi, Celsius, Voyager, and FTX worked. Until they didn’t. After the cascade of blowups in 2022, the survivors learned hard lessons. The yield-chasers got wiped out. The “not your keys, not your coins” crowd was vindicated spectacularly. Most serious holders moved to cold storage or regulated custodians. Still, this is the one area where the paper Bitcoin concern carries the most weight. Lending platforms create real claims on coins that may not actually be there. The risk has shrunk quite a bit since 2022, but it never went to zero. And I suspect it has been creeping higher ever since the purge of 2022. It’s definitely worth watching closely. But there is something else I am concerned about first. 🐷 The Basis TradeMaybe because it’s so foreign to normal investors, or maybe because it just seems confusing. But there is one type of trade that barely gets discussed in the paper Bitcoin conversation. But once you understand it, a lot of the recent price action starts to make more sense. You may have seen charts recently showing record short positions by hedge funds on Bitcoin CME futures. Looks bearish, right? Feels like the big guys are betting against Bitcoin. Here’s the secret: most of them actually aren’t. Those shorts are the other half of something called abasis trade (also known as a cash and carry trade). If that term rings a bell, we covered it in detail in a previous Informationist. If you have not read that yet or want to revise the concept, you can find it here:

James Lavish, CFA·June 16, 2024Read full story Here’s how it works. A hedge fund buys IBIT (or another spot Bitcoin ETF). At the same time, they sell CME Bitcoin futures at a premium. Remember, futures often trade at a higher price than spot because they include expectations about the future. That gap between the two prices is called the basis. When the futures contract expires, the two prices converge. The fund pockets the difference. This is a market-neutral trade. What I mean by that is the fund doesn’t care if Bitcoin goes up or down. They’re just collecting that spread, which for much of 2024 and early 2025 was running 10% to 25% annualized. Easy money, as long as the spread stays positive. Arthur Hayes, co-founder of BitMEX, put it simply on X: “Lots of IBIT holders are hedge funds that went long ETF short CME future to earn a yield greater than where they fund, short term US treasuries.” Translated: “Hedge funds borrowed money at the going T-Bill rate and made a bigger return doing the cash and carry trade on Bitcoin.” So those scary short position charts? Mostly just a bunch of math nerds collecting yield.

But here’s why this matters for the current selloff. By early 2025, the CME annualized basis (the return on that trade) had fallen to around 2%. In other words, for the first time since the ETFs launched, the trade was paying less than risk-free Treasuries. Think about that for a second. You can earn more parking your money in a T-bill than you can running a complicated crypto arbitrage trade. So, why bother? You wouldn’t. And as a result, the funds started unwinding. Sell the IBIT, buy back the CME short. Both of the legs are closed out. Trade over. And what does “sell the IBIT” show up as in the data? That’s right. ETF outflows. Spot Bitcoin ETF AUM dropped from $120 billion in early January to around $90 billion by early February. Ouch. Net outflows ran approximately $8.6 billion in January alone. A big chunk of those outflows were hedge funds closing an arbitrage trade because the math stopped working. Not panic. Not a loss of conviction. Just math. Math that helped lead to a vicious drawdown in Bitcoin price. 😵💫 So What Actually Happened?Now that we have the mechanics down, let’s connect them to what everyone is actually feeling right now. Bitcoin peaked around $126,000 in October of last year. Then Trump announced 100% tariffs on China, and on October 10th, $19 billion in crypto leverage was liquidated in a single day. 1.6 million traders wiped out. The largest liquidation event in crypto history. Bitcoin dropped from $122,500 to $105,000. In a day. And it never fully recovered. The price slipped to $100K and then below, settling into the $85,000 to $95,000 range for months. And if you’re wondering why it couldn’t get back above $100,000, you now have a big part of the answer. The basis trade. All those hedge funds we just talked about were unwinding. Selling IBIT. Closing their CME shorts. Taking the arbitrage off because it stopped paying. And every one of those unwinds showed up as ETF outflows, putting steady downward pressure on price. Then came January 30th. After Trump nominated Kevin Warsh to be the next Chairman of the Fed, markets panicked that a hawk was entering the hen house. Going to eat all their fat little eggs. Gold and silver cracked first. Gold plunged from $5,400 to as low as $4,700, a 13% drop. Silver was even worse, crashing from $118 to $74. That’s a 38% cut in price. Yet Bitcoin seemed to hold in there that Friday, almost unaffected. But this was just an illusion. The weekend brought havoc. Geopolitical tensions escalated, and because Bitcoin trades 24/7, it became the first asset people sold to raise cash. More liquidations. More forced selling. More cascading pressure. Bitcoin broke $80,000 over that weekend and the selling continued into the week, pushing it all the way down to $62,000 on February 5th. So here we sit, now at around $69,000, and people are asking the big questions. Is Bitcoin broken? Has paper exposure finally overwhelmed the scarcity? Is the store of value thesis dead? Fair questions. Important ones. And if you’re feeling that way, you’re not alone. But there’s an asset that went through this exact same crisis of faith. For decades. And it might change how you think about what comes next. 🥇The Gold PrecedentFor anyone holding through this and wondering how it ends, gold has already shown us. The concern about paper derivatives suppressing price? Gold investors have had this exact conversation for decades. Paper gold. COMEX manipulation. Bullion banks keeping the price artificially low. Sound familiar? The paper gold market is enormous relative to physical supply. Price discovery does happen largely in futures. And there have been documented cases of actual manipulation. For example, in 2020, JPMorgan paid $920 million to settle charges that its traders spoofed precious metals futures for years. These are real dynamics. The concern has merit. And yet.

Gold went from $250 in 2000 to $5,000 today. A 20x return. Despite all the paper. Despite all the derivatives. Despite the manipulation, real and imagined. Why? Because central banks wanted real gold. Asian buyers wanted real gold. People who understood monetary history wanted real gold. And when enough real demand meets genuinely limited supply, paper can slow things down. But paper can’t stop them. Now consider Bitcoin. The supply is even more limited. There will never be more than 21 million coins. You can’t discover a new Bitcoin deposit. You can’t ramp up production when prices rise. The issuance schedule is set in code and enforced by a global network of computers. The strongest network in the world. Of those 21 million, roughly 19.8 million have been mined. An estimated 3 to 4 million are permanently lost. Dead wallets, forgotten passwords, Satoshi’s untouched stash. That leaves somewhere around 16 million coins actually in circulation. And that number is only growing by about 164,000 per year. Getting smaller every four years. You can create a trillion dollars of paper Bitcoin exposure. Trade futures and options and perpetual swaps around the clock. But when someone actually wants to take delivery? When a sovereign wealth fund, a central bank, or a corporation decides they want real Bitcoin and not just exposure? There are only so many chairs. Paper markets do affect short-term price discovery. We just watched it happen. But over the long arc, physical scarcity wins. It always has. It always will. 💰 Investment ImplicationsOK this has been a bit of a journey today, so, let’s bring this one home. I’m not calling the bottom. And I’m not saying back up the truck. If you’re over-leveraged or investing money you need for rent, this is a wake-up call, not a buying opportunity. Because who knows what black swan or 100-year event lies around the corner? That said. For the long-term, patient investor who understands what Bitcoin actually is, drawdowns like this last one are part of the deal. They always have been. And the people who understood that have historically been rewarded for their patience. The paper Bitcoin concerns are real and worth understanding. But knowing the mechanics changes how you read the news. To give you an idea, here’s what I’m watching now. ETF flows. When outflows stabilize and consistent inflows return, the basis trade unwinds are likely done and genuine new demand is entering. Worth noting: IBIT just had its highest volume day ever. 284 million shares traded, roughly $10.7 billion in notional value. That kind of volume at a low often marks capitulation, not the start of something worse. Funding rates. When perpetual swap funding (borrowing rate against Bitcoin for leverage) flips negative, that’s the leverage getting cleared. We’re seeing that now. The excess is flushing out. Long-term holders. On-chain data tells you whether people who’ve held for 1+ years are selling or accumulating. When they stop selling and start buying into weakness, that’s historically been one of the strongest signals in Bitcoin. The macro. Bitcoin doesn’t exist in a vacuum. The Fed is stuck between inflation and a slowing economy. When they eventually pivot, and they will, Bitcoin has historically been one of the first assets to benefit. The Bottom LineThe paper Bitcoin question is a good one. And I hope you now have a clearer picture of which products create real demand, which are pure paper, where the genuine risks are, and what’s been driving this selloff. Too much leverage. Too much euphoria at the top. A basis trade that juiced ETF inflows on the way up and is now juicing outflows on the way down. And a macro environment putting pressure on everything. A trigger causes a blowup, causes a liquidation. That’s being corrected. Painfully. And on the other side? The same 21 million coins. The same halvings. The same scarcity. A holder base that’s been battle-tested. Leverage that’s been purged. Infrastructure more robust than ever. The math hasn’t changed. The code hasn’t changed. Just the noise. And the noise always fades. That’s it. I hope you feel a little smarter knowing how Bitcoin derivatives actually work, which ones matter for price, and why scarcity still wins in the end. If you found this valuable, share it with someone who needs to hear it this week. Talk soon, James ✌️ Bitcoin’s history is filled with violent corrections. And time and again, these moments have separated emotional, reactive investors from disciplined, long-term ones. As Warren Buffett famously put it: “Be fearful when others are greedy, and greedy when others are fearful.” This isn’t investment advice; just essential context for understanding why selloffs occur and how they’ve historically created asymmetric opportunities for those prepared to act rather than panic. If this framing resonates or if you see it differently, I’d genuinely welcome your thoughts and feedback. If you find this perspective helpful, you’ll find more educational resources like this at www.TheBitcoinDentalNetwork.com, created to help professionals better understand the financial waters we’re all swimming in. To Your Financial Freedom! Mark R. Link D.D.S. |

The Bitcoin Dental Network

I’m a restorative dentist who got a hard wake-up call during the 2008 financial crisis. Since then, I’ve poured thousands of hours into understanding money, risk, and why costs keep rising in healthcare. I share the most useful, actionable resources I’ve found—especially for dentists, but helpful to anyone—so you can protect your financial health and your practice. That’s why I built The Bitcoin Dental Network. It’s free, practical, and no strings attached.

Hello Reader, Last week’s sharp selloff in Bitcoin, gold, and silver caught many investors off guard, but moves like this are not unusual, especially in Bitcoin’s history. What is unusual is how little most retail investors understand about what actually causes them. In this week’s article, James Lavish explains the mechanics behind the drawdown, ETF flows, derivatives, leverage, and institutional “basis trades”, and why short-term price declines often have far more to do with market...

Hello Reader, Most of us spent years in school learning how to care for patients and run practices, but almost none of us were ever taught how the monetary system we work inside of actually functions. That’s not a failure on anyone’s part. It’s just a gap in standard education. I came across a long-form video this week that does a surprisingly clear job explaining: How the modern money system has worked since the early 1970s Why inflation, debt, and periodic “resets” aren’t random And, most...

Hello Reader, Video of the Week (and First of 2026): Bitcoin for Beginners (2026) Matthew Kratter – Bitcoin University Watch the Video Here: A new year invites reflection and often a few resolutions. Most focus on health, relationships, or personal growth. But here’s a question worth asking as we begin 2026: What if this were the year you finally understood money and how to become financially free? That’s why I chose this video as the first Video of the Week for 2026. Matthew Kratter does an...